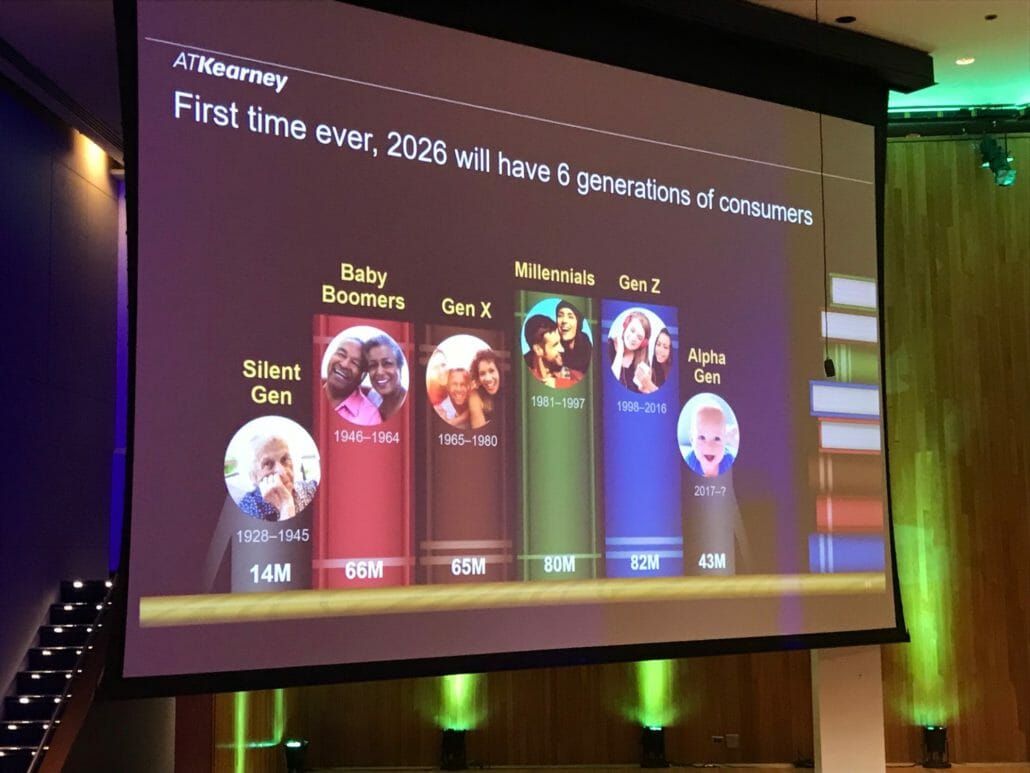

The ACG Annual Consumer & Retail Conference took place in New York City on November 7th. The Association for Corporate Growth, or ACG, is the global community for middle-market M&A deal-makers and business leaders focused on driving growth. This event brought together ACG’s wide variety of PEGs, service members and business leaders looking to identify new economic patterns and consumer behaviors as we move into 2019. The guest speakers included the Co-Founder & Co-CEO of Warby Parker and Harry’s, Inc, Jeff Raider and Sameer Anand, Partner at A.T. Kearney.

How Consumer Packaged Goods are Changing

In recent years, Consumer Packaged Goods (CPG) have undergone enormous growth and have transformed the ways that consumers interact with and perceive brands both on and offline.

With the explosion of social media and e-commerce, brands are now able to launch and gain significant market share 50% faster than in the past.

How to Slate Your Brand for Success in the Age of Data and Personalization

The trends of new companies that are succeeding the most have an engrained social strategy. Brands that build a community around their products, services and values are coming out on top. For example, Warby Parker’s business model of donating a pair of glasses to a person in need for each pair sold has helped solidify their position as a leading eyewear company.

Models that relied on retail push-pull strategies with a focus on retail categories and distribution channels are quickly seeing new brands winning by establishing trust and values to anchor consumer behavior.

Winning means companies must work not harder, but smarter using data and personalization to appeal to the modern day consumer.

Newer brands are much more nimble and tuned into consumer behavior compared to older, corporate brands. This provides a major attraction for corporate sponsors to move quickly in acquiring these smaller brands. A new benchmark has been established for acquisition targets. Buyers are much more eager to gobble up smaller companies that might have only $20 million in revenue in their first few years. The ones that have demonstrated competency with their digital presence, resonate through their value proposition and have jumped ahead of crowded categories—or new ones, are valued for the goodwill they have established. Large, layer ridden corporations recognize the cost of customer acquisition as well as not having these competencies or skill sets on board.

With more opportunities for acquisitions, targets are commanding corporate multiples of revenue vs EBITDA. Everyone wins in this scenario: smaller brands reach more people, buyers expand their portfolios, and investors get quicker returns. A new, savvy investor community is emerging with wider asset classes and new skills. PEGs seek brands who have established a community of loyal followers.

On the opposite end of the spectrum, traditional consumer brands are receding in top line and value. A pet food or cereal brand that would have only been sold through grocery retail channels is less appealing to investors compared to cutting-edge technology and consumer brands who are tapping into the social landscape. Take for example Harry’s Shave Club who took a very crowded category and morphed it into a massively successful customized online experience for consumers.

Retailers like sporting goods and Toys ’R Us are also struggling to adapt to consumer behavior that is moving more towards e-commerce and personalized, on-line shopping experiences.

Conclusion

At the end of the day the consumer rules. Brands in many categories are vying for our wallets. Those that capture loyal consumers and followers are quickly on buyers’ radar screens. Amazon and the overall democratization of the internet have changed the retail landscape as we know it. Success will live and die by the review. Distribution channels are greased for next (or same) day delivery. In 2019, the consumer will be in command more than ever.

Baysource Global’s CEO, David Alexander, a long-time member of ACG has worked with private equity groups helping their portfolio companies improve their performance and increase value. Baysource Global assists clients with hands-on, experienced boots-on-the-ground professionals with Asia supply chain and market launch strategies.

Follow Us